MLP Mutual Funds: Navigating the Energy Landscape

Investing in the energy sector offers the potential for substantial returns, but also presents unique challenges. Master Limited Partnerships (MLPs) – companies that own and operate energy infrastructure – are a key component of this sector. MLP mutual funds, which diversify investments across multiple MLPs, provide an accessible entry point. However, understanding the nuances of these funds is critical for success. This guide provides a practical framework for evaluating and investing in MLP mutual funds, focusing on managing risks and building a resilient portfolio.

What are MLP Mutual Funds?

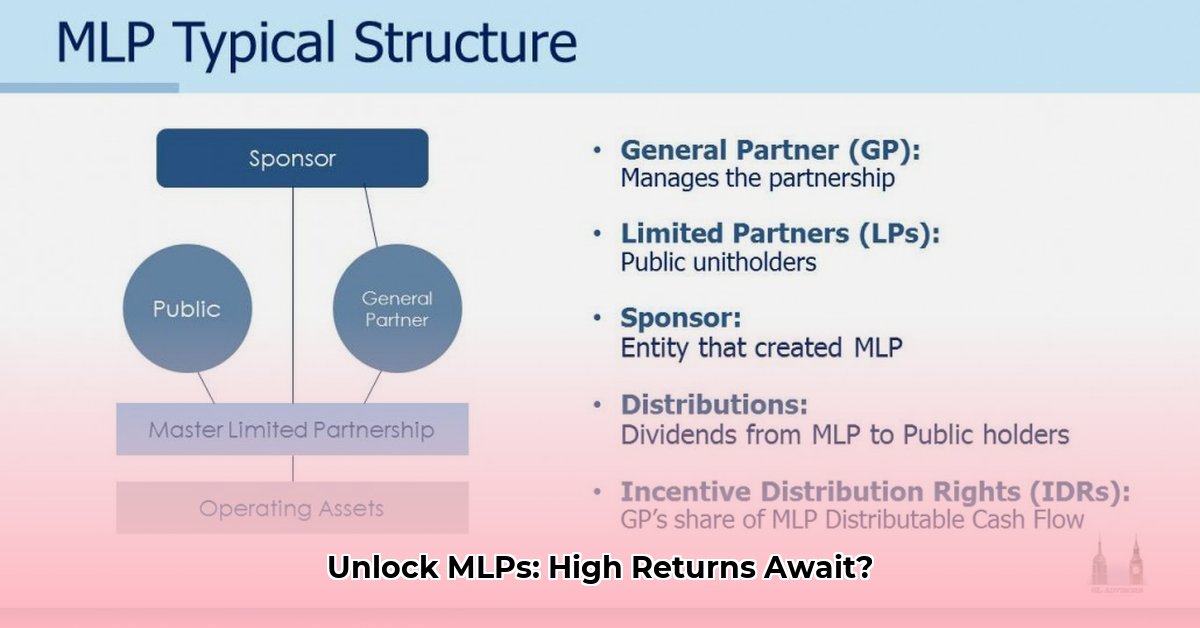

MLP mutual funds are diversified investment vehicles that pool capital to invest in a portfolio of Master Limited Partnerships (MLPs). MLPs typically own and operate essential energy infrastructure, such as pipelines, storage facilities, and processing plants. These funds often distribute a significant portion of their income as dividends, potentially providing attractive income streams for investors. (Think of them as a diversified bet on the physical backbone of the energy industry). However, this high-yield potential comes with significant risks.

Quantifiable Fact: MLPs often exhibit higher dividend yields compared to other investment sectors, but historical data shows significant volatility correlated with energy price fluctuations.

The Allure and Risks of High Yields

The high dividend yields offered by many MLP mutual funds are a significant draw for income-seeking investors. These payouts are often generated by the stable cash flows from the underlying energy infrastructure. However, these yields are not guaranteed. Their sustainability is intrinsically linked to energy prices, regulatory changes, and overall market conditions.

Rhetorical Question: Given the volatility of energy prices, how can investors effectively assess the long-term sustainability of MLP dividend yields?

Evaluating MLP Mutual Funds: Due Diligence

Before investing, investors must conduct thorough due diligence, considering the following critical factors:

Fund Manager Expertise: Assess the fund manager's experience and track record in the energy sector. A proven ability to navigate market cycles is crucial.

Diversification: Analyze the fund's holdings for diversification across various MLPs and energy sub-sectors. Over-concentration in specific MLPs or energy types increases risk.

Expense Ratio: Compare expense ratios across funds. Lower ratios directly translate to higher returns for investors.

Distribution History: Examine the consistency of past dividend payouts. Irregular or declining distributions may indicate underlying issues.

Tax Implications: MLPs have unique tax structures. Consult with a tax professional to understand the potential tax implications before investing.

Expert Quote: "Thorough due diligence is paramount when evaluating MLP mutual funds," says Dr. Anya Sharma, Professor of Finance at the University of California, Berkeley. "Understanding the fund manager's strategy, the portfolio's diversification, and the underlying MLPs' financial health is crucial."

Building Your MLP Investment Strategy: A Step-by-Step Approach

Investing in MLPs requires a structured approach:

Assess Your Risk Tolerance: Only invest funds you can afford to lose. MLPs are generally considered high-risk investments.

Diversify Your Portfolio: Integrate MLP mutual funds as part of a broader investment strategy, diversifying across different asset classes and sectors to mitigate risk.

Monitor Performance: Regularly review the fund's performance, paying attention to key metrics such as dividend payouts and net asset value. Stay informed about relevant industry developments.

Seek Professional Advice: Consult with a registered financial advisor who can provide personalized guidance based on your individual investment goals and risk profile.

The Future of MLPs: Adapting to Change

The energy sector is transitioning. The increased focus on renewable energy sources and stricter environmental regulations presents both challenges and opportunities for MLPs. Many MLPs are actively diversifying into renewable energy-related projects. However, the long-term impact of this shift on MLP valuations remains uncertain.

Quantifiable Fact: The renewable energy sector is projected to experience significant growth in the coming decades, potentially influencing the long-term viability of traditional energy MLPs.

Weighing the Pros and Cons: A Balanced Perspective

| Pros | Cons |

|---|---|

| Potential for high dividend yields | Significant sensitivity to energy price fluctuations |

| Diversification across multiple MLPs | Regulatory and environmental uncertainties |

| Access to specialized energy infrastructure | Complex tax considerations |

| Professional fund management | Dependence on continued high energy demand |

Investing in MLP mutual funds demands careful consideration of both the potential rewards and the inherent risks

Mitigating Risks in a Transitioning Energy Market

The energy sector's evolution presents both challenges and opportunities. Successfully navigating this landscape requires a proactive risk-management strategy. The following steps can help mitigate financial risk:

Diversification: Spread your investments across various energy sectors (renewable and traditional) and asset classes. This reduces your vulnerability to any single risk factor.

Due Diligence: Thoroughly research individual MLPs before investing, considering factors such as financial health, management team, and operational efficiency.

Regulatory Monitoring: Continuously monitor changes in energy regulations. This allows you to proactively adjust your portfolio to mitigate potential negative impacts.

Long-Term Perspective: Avoid short-term trading decisions that are susceptible to market fluctuations. Instead, adopt a long-term investment horizon for sustained growth.

Professional Guidance: Consult with a financial advisor specializing in energy investments to help you develop a robust and personalized investment strategy.

This comprehensive approach, along with continuous learning and reassessment, is key to successfully harnessing the potential of MLP mutual funds while mitigating the inherent risks. Remember, the energy sector is dynamic—adaptability is key.